Revocable Living Trust Illinois

Living trusts in illinois.

Revocable living trust illinois. While a living trust can serve a number of valid purposes it is generally not the only answer. Using an attorney means that the trust will be completed correctly but the associated fees can greatly increase the cost of creating a living trust. In the absence of a revocable living trust or a power of attorney a guardianship proceeding would be necessary to grant the ability to manage the disabled individual s affairs. It allows you as the grantor to have flexibility in how adobe pdf.

These can often be costly time consuming and stressful for the disabled individual s family. A revocable living trust illinois may be right for you. Some illinois residents choose to plan their estates and get their affairs in order using revocable living trusts. Illinois has a simplified probate process for small estates under 100 000 excluding real estate.

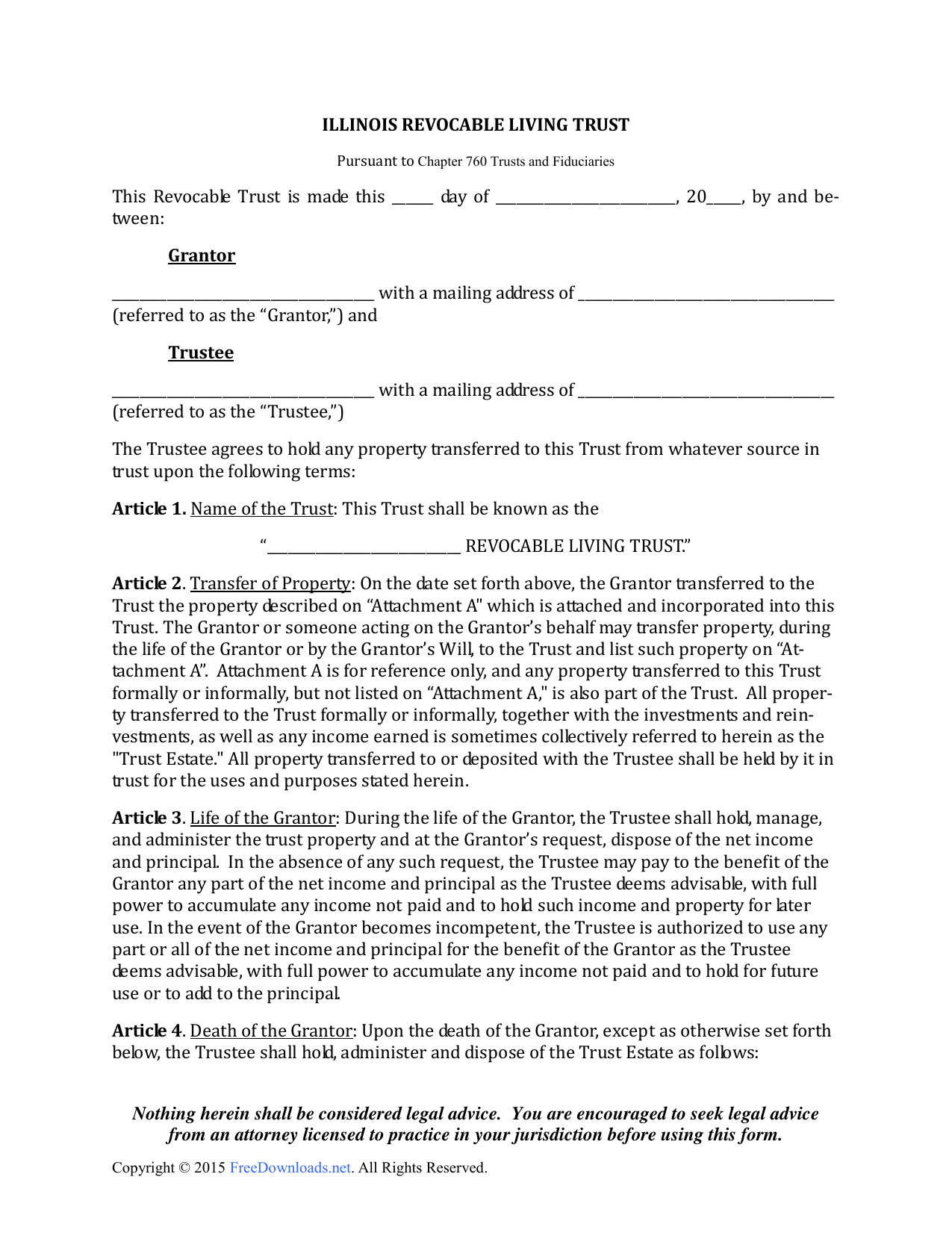

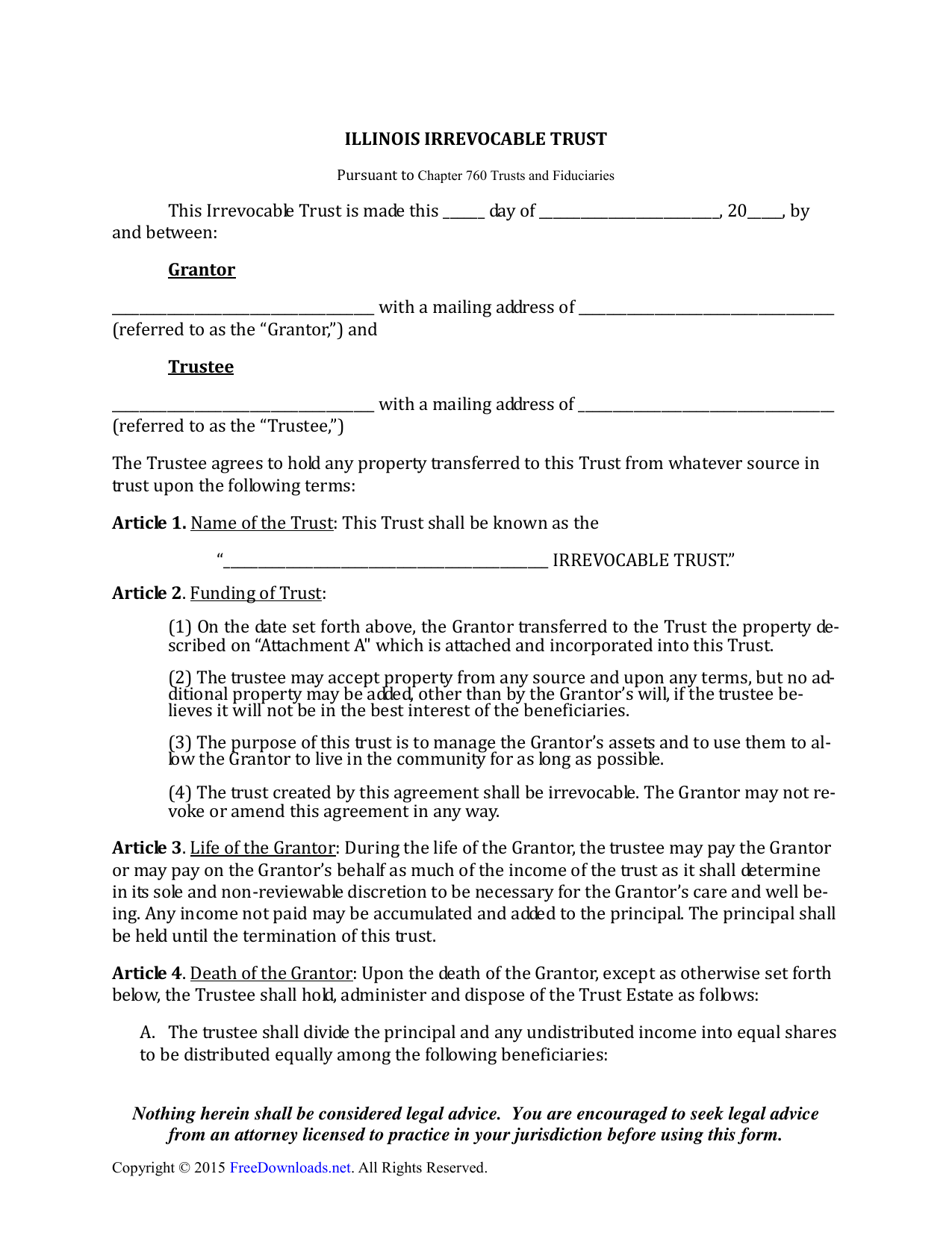

Aside from avoiding probate the grantor person who establishes the trust has continued access to their assets if they become incapacitated in any way. Illinois revocable living trust form. Simply executing a living trust will not materially affect the disposition of your assets will not save estate taxes and may not reduce administration costs after your death. A living trust is created by a trust agree.

Illinois does not use the uniform probate code which simplifies the probate process so it may be a good idea for you to make a living trust to avoid illinois s complex probate process. An illinois living trust is created during the grantor s life. The illinois revocable living trust is an entity into which a person places their assets to save the inheritors the long and costly probate process in illinois. The use of a living trust is an important estate planning option.

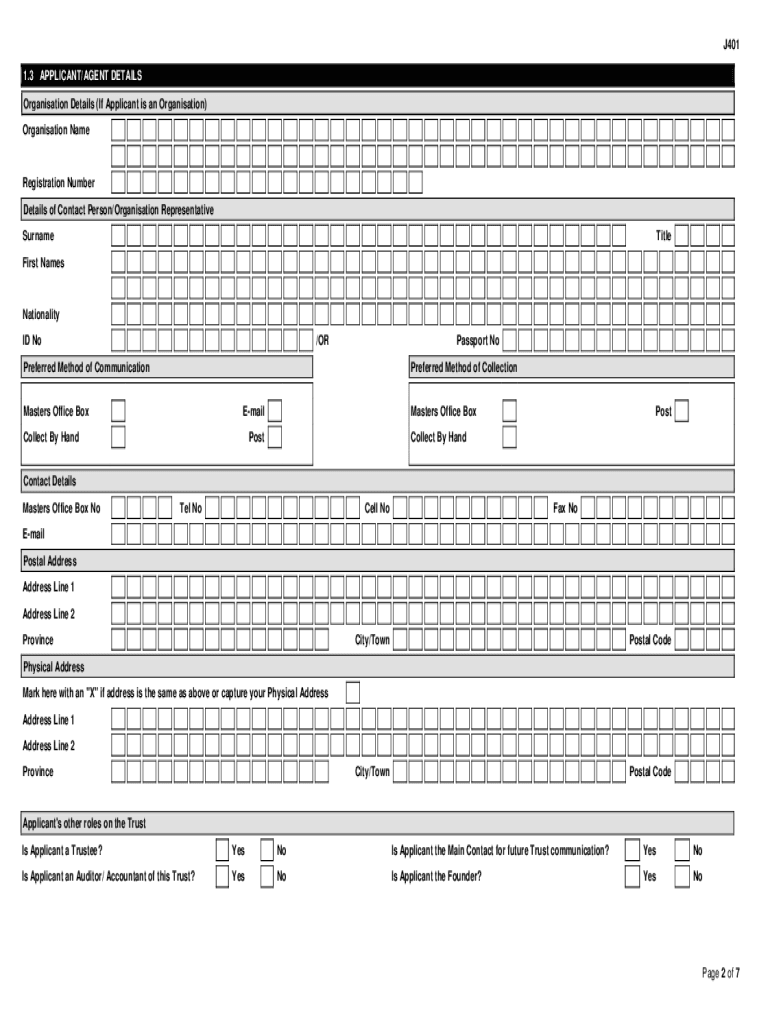

A trustee is chosen. Assets are transferred into the ownership of the trust and usually the goal is to transfer as many as possible special accounts like iras 401 k s and keoughs do not qualify. Illinois irrevocable living trust form. An illinois living trust is a document that allows the recipient s of a deceased individual s assets to avoid the court supervised probate process implemented after a person dies the initial creator of the trust referred to as the grantor will transfer property and assets to the trust and outline specific instructions for what shall be done with said property and assets when they die.

The average cost for an attorney to create your trust ranges from 1 000 to 1 500 for an individual and 1 200 to 1 500 for a couple.