Rental Property Carpet Replacement Ato

Her total interest expense on the 400 000 loan is 35 000.

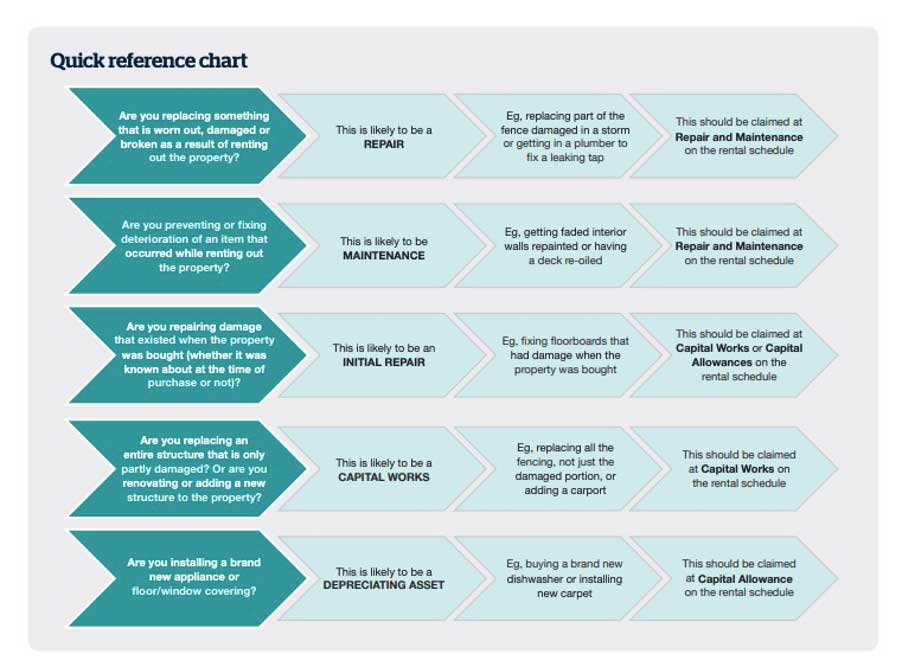

Rental property carpet replacement ato. However top grade carpets in high end. Generally replacing a worn carpet qualifies as a deductible expense. But if the carpet in a residential rental property is glued down it is considered to be part of the building structure and must be depreciated over a whopping 27 5 years. Ato gov au rentalpropertyguide read our guide to capital gains at.

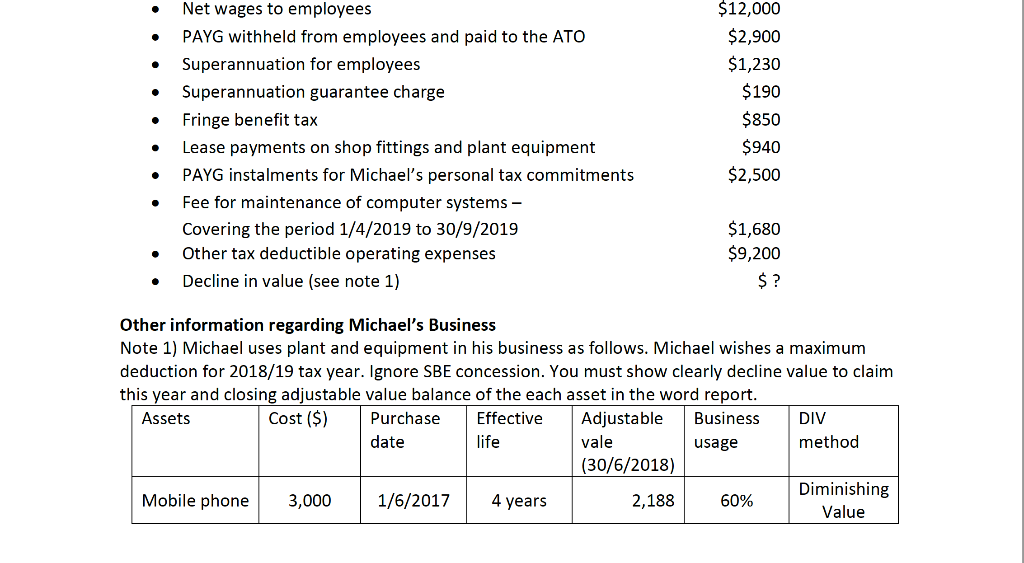

Yoko takes out a loan of 400 000 from which 380 000 is to be used to buy a rental property and 20 000 is to be used to buy a new car. Yoko s property is rented for the whole year from 1 july. You can claim a tax deduction for expenses relating to repairs maintenance or replacement of machinery tools or premises you use to produce business income as long as the expenses are not capital expenses. In addition to your operating expenses you can deduct from your rental income any expenses related to the property s upkeep.

There s a few things to consider when it comes to claiming deductions on your rental properties. For more information go to. Welcome to our community. This is a general summary only.

Tax free exchange of rental property occasionally used for personal purposes. Ato gov au rental watch our short videos at ato gov au rentalvideos download our free rental properties guide at. Rental expenses you can t claim such as costs your tenant paid deductions unrelated to your investment property and the cost of travel you incur relating to your residential rental property. Claiming a tax deduction for repairs maintenance and replacement expenses.

This guide explains how to treat rental income and expenses including how to treat more than 230 residential rental property items. Rental property as well as purchase and sale records. Today most carpets are tacked down and qualify as personal property with a five year deprecation period. This video explains when you can claim a deduction for rental property expenses.

Rental properties and travel expenses. A capital expense is money spent to purchase assets like plant and equipment. If you meet certain qualifying use standards you may qualify for a tax free exchange a like kind or section 1031 exchange of one piece of rental property you own for a similar piece of rental property even if you have used the rental property for personal purposes. If the carpet is tacked down it is classified as personal property and is depreciated over five years.

For more information.